The act of paying off debt can be both tricky and stressful. Many people are beset by the prospect of owing large chunks of money — whether stemming from school payments, the maxing out of credit cards, or even paying off debts from fellow family members. For those unfamiliar with proper ways to go about paying off debt, the proposition can also seem very overwhelming.

There are sensible moves to make. This includes making more than the minimum on monthly credit card payments. In addition, a prudent step would involve mapping one’s finances — with sacrifices made towards lessening debt rather than the consistent enjoyment of entertainment/eating out.

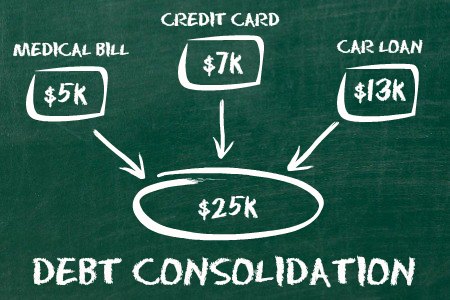

However, there’s also the plan of consolidating debt into a lump sum payment. There are a number of ways to approach this method. For one, individuals may seek out debt consolidation services — such as ConsumerCredit.com, American Financial Solutions, and National Debt Relief. These institutions will work side-by-side with customers to consolidate debt into one primary loan. For example, money owed on a credit card can be meshed together with outstanding debt for university fees as well as a department store card.

The procurement of a 0-percent balance transfer card allows for the customers to transfer all other credit card balances over to this specific card. The caveat is that a high credit score (normally north of 690) is required for attaining this card. No interest is usually present for up to a year and a half. Another way to consolidate debt includes taking a loan or line of credit out on the equity in one’s home. This primarily works for those who are in fact homeowners.

The money from a home equity loan/a line of credit can be used to pay off credit card debts (or any other sort of debt). When compared to an unsecured loan, this option usually involves a lower interest rate. Those without excellent credit also are able to exercise this choice.

For those with a 401K at their place of employment, one could take a loan out from it. This may hurt retirement funds down the line. However, this loan will be absent on any credit report. This also has a lower interest rate than the normal unsecured loan would have.

Lastly, one can obtain an unsecured personal loan from one’s local credit union/bank. One has to do their due diligence as it pertains to the language surrounding the loan. Low credit scores could result in lower interest rates and collective flexibility. There are also online lenders made available. Each one varies in terms of up-front fees. If one’s credit isn’t up to snuff, the respective interest rates could be higher across the board.

Image Sources: Guardian Debt Relief